How we manage money

Is managing money an art or a science? We definitely lean more towards science

Our seven guiding principles have stood us in good stead, particularly during tough economic times.

Asset allocation and a long-term timeframe is key

We believe the majority of returns are driven by asset allocation, so it’s important to get this right. By staying invested for the long term, you avoid missing the best increases in the market.

Nobody has perfect foresight

We cannot predict what will happen tomorrow, so we ensure that portfolios are properly diversified. We steer clear of being too reliant on specific assets or regions.

Financial markets are not always efficient

We add value through tactical tilts in portfolios. We layer agile tactics over a foundation of fundamental strategies.

Emotional responses can damage wealth

Making decisions based on emotions can be damaging. We rely on experience, discipline and patience.

It’s important to be objective

We collaborate with specialist third parties to ensure our opinions are informed and impartial.

Controlling costs is critical

The impact of costs can be significant on clients’ investments. We’re flexible in the way we invest (active or passive) and are always striving to drive down costs.

Learn lessons

We constantly review and evolve our investment process.

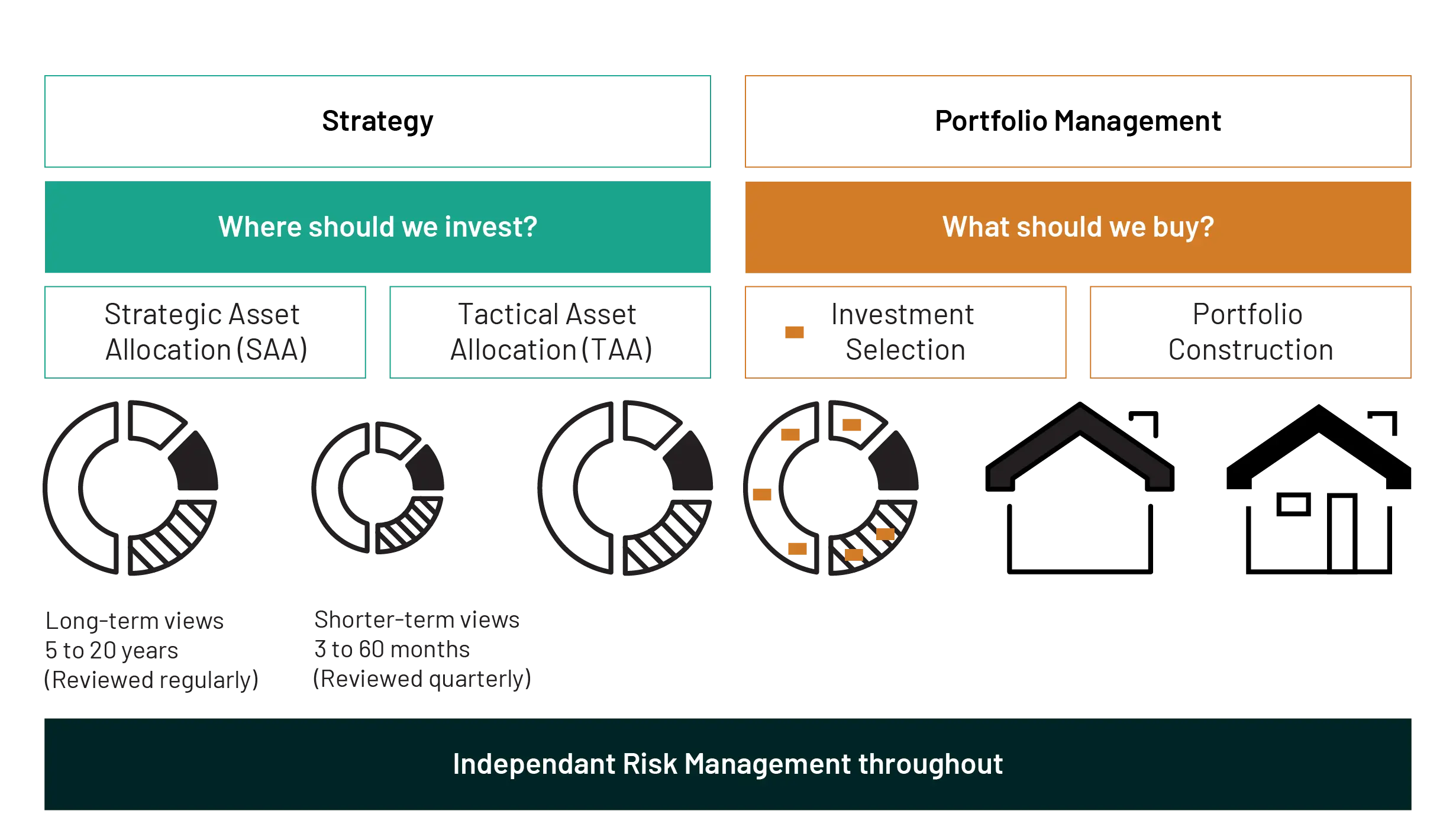

Our approach

We believe that to do something properly, you have to have a plan. In our case, that means a long-term investment plan for each portfolio. Our teams are structured to fulfill this plan, and identify any short-term tweaks we can make. Our process ensures that each decision is carefully considered, monitored and reviewed.

Strategic asset allocation (SAA)

The foundation of our portfolios and risk-rated funds is our SAA, taking a long-term view of five to 20 years. Our strategy team advises which asset classes have the most potential for growth, with our investment committee having the final say.

Tactical asset allocation (TAA)

At the same time, our tactical asset allocation committee thinks about shorter-term opportunities (three to 60 months), applying temporary tilting to maximise returns. Here too, the investment committee has the final word.

Portfolio selection

To deliver our SAA and TAA, our Portfolio Management Team have a rigorous manager selection process, using criteria such as performance, investment process and portfolio positioning.

Risk management

Our Investment Risk Team independently analyse all our positions and portfolios. Looking at different time periods and risk environments, they use an industry-leading risk system, and tools such as stress testing and scenario analysis.

Discover more about 7IM

Meet the 7IM Intermediary Team

Our experienced team of incredibly helpful and knowledgeable people are here to help you.

Find out more

7IM funds

We’re not just fund managers, we’re fund management pioneers - come and explore our funds.

Find out more

Cleaner investments

Here at 7IM, we are guided above all by the responsibility we have towards our clients and their assets.

Find out more