Monthly commentary

Calendar fallacies

Happy New Year!

Unless, of course, you celebrate Lunar New Year, in which case there’s still six weeks to go before the Year of the Fire Horse begins on 17th February. And there’s another month after that if you observe the Hindu New Year (19th March), or if you’re in Iran – unlikely, I’ll admit – when Nowruz isn’t until 20th March. In Thailand, the fireworks won’t go off until 13th April, and the Islamic New Year isn’t until June.

Each January, I’m always struck by the social psychology of the calendar and the group behaviour it encourages. Like when the bells chime at midnight and everyone inexplicably crosses hands and belts out an 18th century Scottish song, without ever really knowing why. Or the slip-stutter we all adopt for the whole of January when saying the date; “Twenty Twenty-Five… I mean SIX!”.

And of course, the absolute fervour that runs through financial markets; This will be the year which is predictable ahead of time. Yeah, right.

Usually, something happens within the first quarter or so (around the same time as everyone’s New Year’s Resolution to diet/exercise/read more fails), which throws everything up in the air again. My first draft of this was on 2nd January, but I thought I’d polish it over the weekend. I’m glad I waited, because this year, Donald Trump’s gone early!

I’ve got nothing to add to the onrush of analysis on Latin American Politics, crude oil geology or the remits of international law; that’s what Twitter’s for. I’d just note that, once again, at the start of the year, there are lots of reasons to be fearful, and plenty of doomsayers are already emerging. They’ll sound convincing, they do every year. But most of the time, their scare stories don’t materialise. And if they do, the world (and more importantly, portfolios) are robust enough to just keep on rolling. Riding the Fire Horse (i.e. staying invested) is the right thing to do…

Chart of the Month

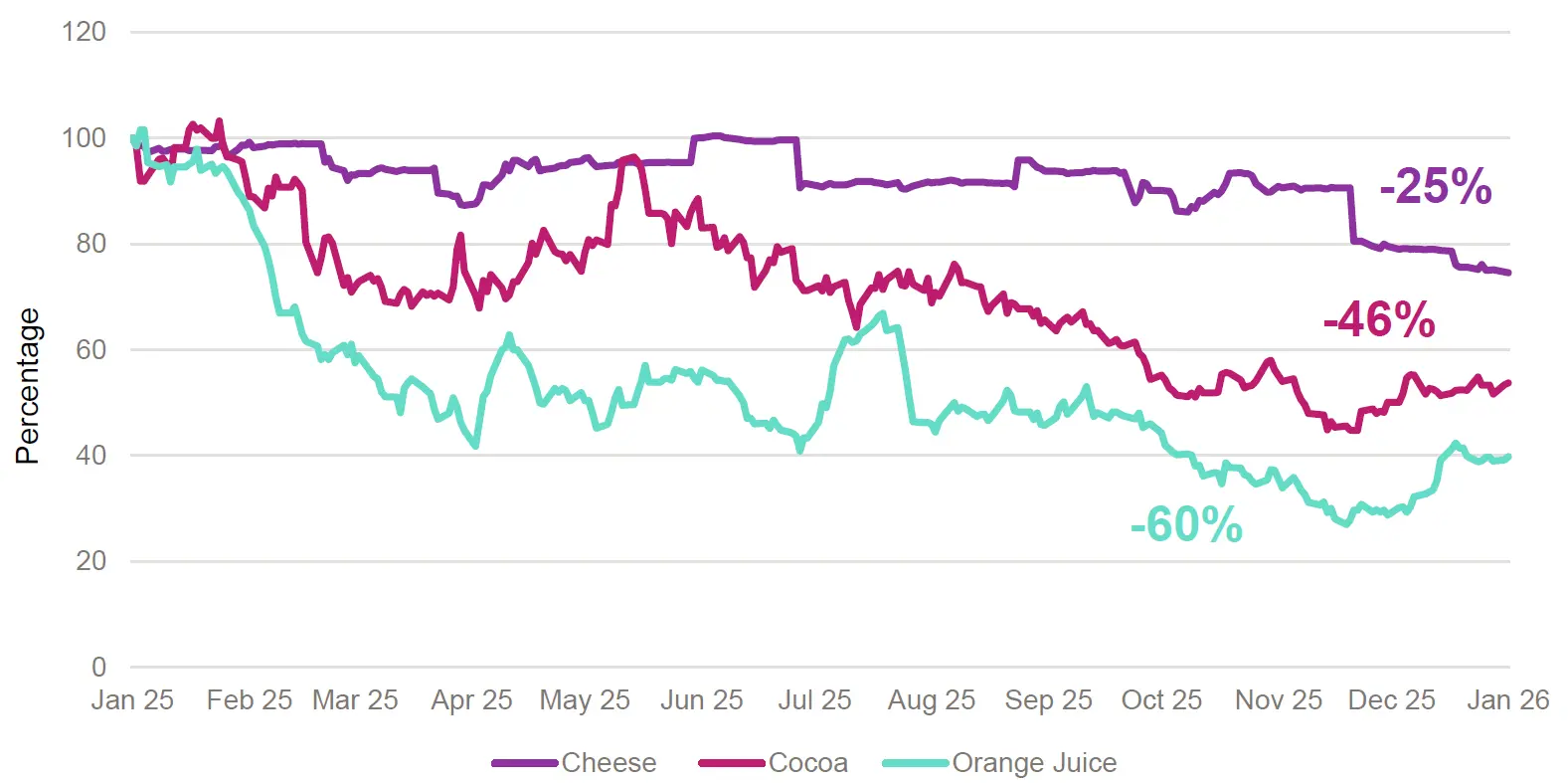

Source: 7IM/FactSet. Futures Prices rebased to 100

Central bankers think about inflation constantly, using lots of complicated economic signals and statistical models for estimating the impact. For the rest of us, our awareness of inflation often comes via the taste buds. In the past couple of years, noticeable areas of increase have been cheese, chocolate and orange juice. All of those have experienced their own supply issues (for various reasons), forcing prices upwards.

Yet, as you can see from the chart above, the prices of these goods are starting to fall from their heady heights amid easing supply constraints and positive harvests.

December Markets Wrap

The “Santa Rally” rewarded diversification in December, with all major equity markets outside of the US experiencing a strong month.

Markets managed to manoeuvre what was a complicated month of economic signals with an interplay of economic data, trade policies, and geopolitical risks continuing to cause investors headaches. This was experienced most in the US, with profit taking from the large tech names being the main driver of a flat month for the S&P 500, alongside continued economic uncertainty. The FTSE 100 finished the year on a positive note, flirting with the momentous 10,000 mark, given strong performance in mining and defence sectors, along with renewed rate cut optimism given slowing inflation. Emerging markets continued their strong 2025 run into the final month of the year, with renewed positivity around China’s growth prospects sending the MSCI Emerging Markets up a further 3%, adding to its one-year return of 34%.

Despite rate cuts fuelling some optimism in the equity market, in fixed income land, little changed, given that many of the cuts were heavily anticipated and future cuts uncertain, due to pockets of “sticky” inflation, which fuels fears of higher rates for longer.

Market Movers

Source: Bloomberg Finance L.P. Data as of 31 December 2025. Past performance is not a guide to future returns. Quoted returns are in the local currency of the market

What we’re watching in January

- Before the end of January: Trump to announce a new Federal Reserve Chair (81% likely to happen before February, according to prediction markets)

- 28th January – Federal Reserve meeting.

- Throughout January – Retailers release Christmas trading statements (Next, Tesco, Sainsbury, Costco). It should be a useful guide as to how “alive” the consumer is.

More from 7IM