Responsible Choice Rebalance Commentary

Overview

The summer months tend to be a calm period for markets, but 2024 has somewhat bucked that trend.

The three months since the last rebalance have seen turbulent economic data, volatile equity markets and, with the return of rate cuts, a day in the sun for fixed income assets. We discuss the events in more detail below – but from a portfolio sense, we’ve been expecting something like this for about a year, so already had positions in place.

US interest rates became the driving force behind much of the activity seen across the globe, as Jerome Powell and the Fed (a good band name?) began talking about a rate cutting cycle. With the US economy not particularly showing signs of broad stress, this reinforced the narrative around a soft landing.

In such a world, investors began looking outside of the winners of the past year – the long-awaited market rotation. This is a world in which the Magnificent 7 begin to share the spotlight with some of the unloved sectors of the market – healthcare, banks and smaller cap companies. The optimal version of that world – which we saw for most of July – is one where the large tech names move sideways, while everything else rallies. Markets remain positive, but led by new champions…

However, a very strange Friday in early August demonstrated the other version of the rotation. Equity markets around the world had their worst days since 2008. In fact, Japanese markets – catching up with events on Monday morning – had their worst day since 1987.

There were plenty of different reasons ascribed to the panic: weak US economic data, the reversal of the Yen carry trade, Bank of Japan rate rises, AI “bubble” and even some obscure views around the impact of algorithmic trading on a quiet summer’s day. Whatever the underlying cause (likely a combination of all of the above), within a couple of weeks, everything was back to normal! Which in itself, isn’t that normal!

We’ve positioned portfolios to weather such short-term storms, as well as for the hopefully benign broadening out seen in markets over the last three months. Our fixed income allocations provided the cool calming counterpoint to the otherwise heated equity market environment, while our more diversified equity holdings also offered protection and upside.

Core investment views

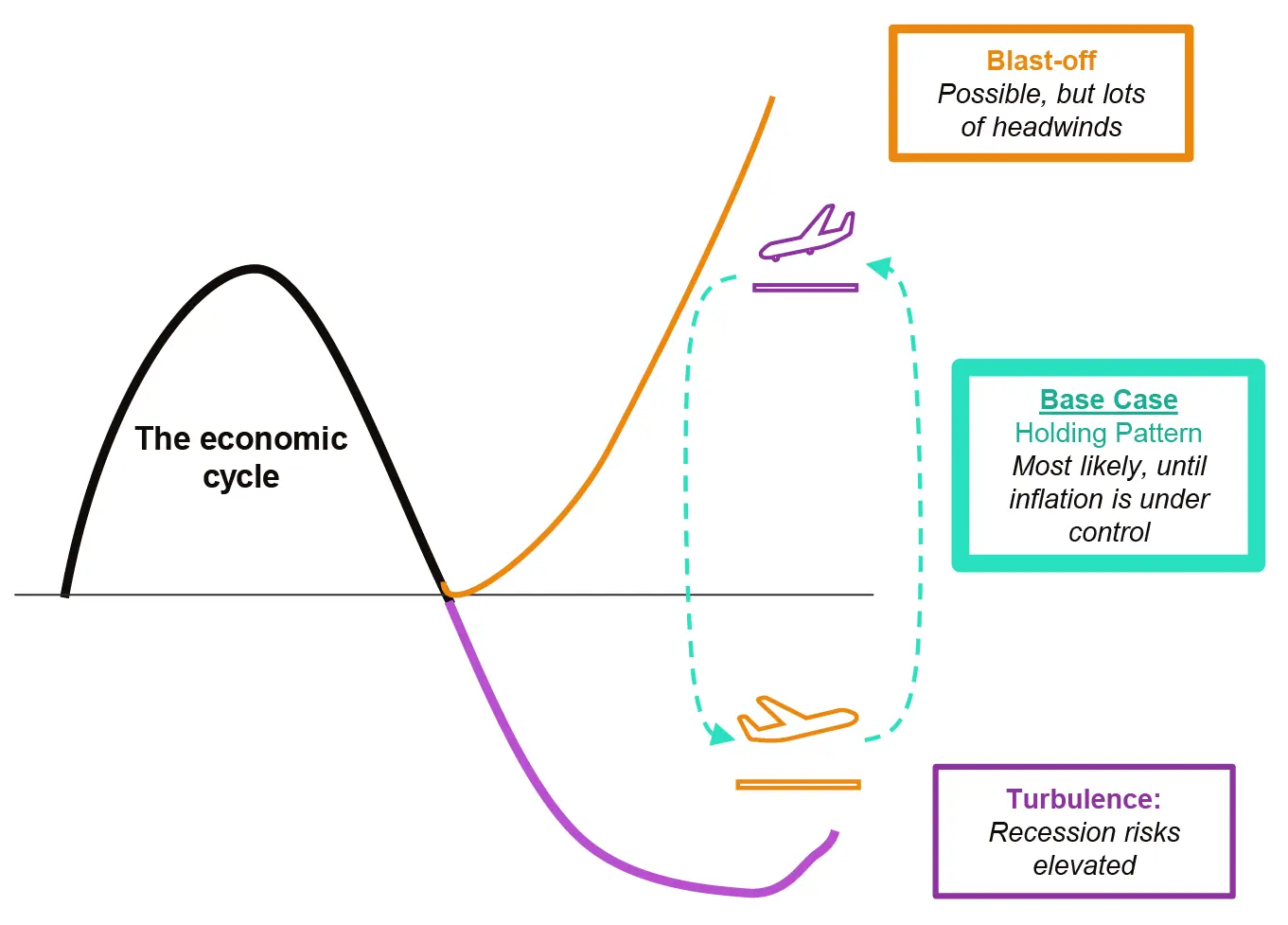

After more than a decade of lurching from one financial crisis to another, the markets are gradually remembering that economic cycles are normal.

And in those cycles – the same way that an aeroplane isn’t always ascending and descending – the economic world spends most of the time between extremes. There will be a mixture of good and bad data, and of policy responses; but only rarely will these result in large market shifts.

That’s where we are at the moment – a Holding Pattern.

Over the next 12 months, we expect:

- Economic growth to be positive but slowing as the lagged impact of rate rises comes through. We wouldn’t be surprised to see US GDP growth at 2%, rather than 2.3%, for example.

- Inflation to keep falling, but only because interest rates don’t. We’ve consistently said that central banks are going to make sure that inflation is crushed, before they start to really cut interest rates. And the end destination for rates isn’t zero.

- Our quantitative signals suggest that only small tactical deviations from neutral are appropriate, as we’d expect in the middle part of a cycle. A slight underweight to expensive concentrated equity markets (predominantly avoiding the US), and a small overweight in fixed income to take advantage of high yields in a defensive asset class.

Tactical Asset Allocation

As the markets adjust to a more normal economic cycle, traditional relationships should reassert themselves. Indices will become less concentrated, as the spotlight moves away from recent winners to either cheaper quality companies, or cheaper high-growth companies.

We will see markets begin to favour assets which can weather a more volatile growth and inflation environment. We want to hold the right equities – with robust earnings, strong balance sheets, able to deal with a higher interest rate environment than the last two decades.

| Quantitative Macro | Model-driven allocations, reflecting 6-12 month macro outlook |

|---|---|

| Equity | Small underweight: Most fundamental economic signals are around neutral; our positioning reflects slightly elevated recession risk alongside high valuations and increasing concentration across equity markets. |

| Fixed Income | Small overweight: Government bonds are, for the first time in over a decade, offering a real yield that’s compelling. In addition, they offer protection during market downturns. However, given some of the unwinding in central bank books, there are some liquidity indicators which caution against a stronger overweight. |

| Diversification | Evidence-based diversifiers, which outperform through multiple market cycles |

|---|---|

| Healthcare | Healthcare is a typically defensive sector, which we like as a hedge against the growing concentration in US markets. At the same time, the valuations are attractive vs history and the longterm theme has strong support. |

| Tactical Opportunities | Mispriced areas of the market with the potential to deliver meaningful excess returns |

|---|---|

| AT1s/European bank bonds | Small holding in bonds, which have higher yields than other corporate debt from similar standard issuers. European banks are the safest they’ve ever been, so we’re happy to be paid a little bit more for lending to them. |

| Climate transition leaders | As governments around the world embark on green investment strategies, they will turn to existing private sector businesses for expertise and execution. Whether it’s cleaner concrete, more efficient recycling, or battery tech, there are opportunities for the current leaders. |

| Portfolio themes | Comment |

|---|---|

| The world is getting older |

The healthcare sector is best placed to take advantage of this. The sector still trades at a discount, and we believe that it is starting to be recognised for its strengths – especially given its importance during the Covid pandemic. |

| Fighting climate change |

Climate change is one of the biggest threats that humanity faces in the future; without drastic action, the planet will warm by more than the 1.5°C level agreed on in the Paris Agreement. The Responsible Choice Models target companies that are managing their environmental risks and investing in a cleaner future. |

| Emerging markets will drive change |

The funding gap to meet the Sustainable Development Goals by 2030 is between USD 6-8 Trillion, and 70% of that is needed in emerging markets. This creates opportunities that we can access in equity and fixed income markets. |

| Global impact | Impact investments are those that lead to a material and measurable improvement in environmental and social problems. The Responsible Choice Models have access to companies that are driving positive change around the world. |

| Sustainable finance | The private sector will be increasingly leaned on to drive environmental change and find solutions for an ageing population. The Responsible Choice Models have exposure to both green bonds and social bonds, which are linked to sustainable projects. |

Asset allocation changes

This quarter we have completed the transition to the 2024 Strategic Asset Allocations. Additionally, we made a few tactical changes to portfolios this quarter:

- A small reduction to the government bond overweight

- A further trim to the AT1s position as prices continued their recovery back to their highest in nearly three years

Manager changes

There were no manager changes made this quarter.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

You can download the commentary as a PDF here.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.